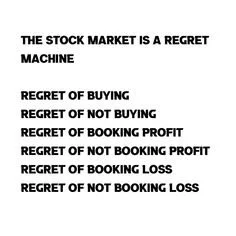

REGRETS

Maintaining Calm

The stock market will ebb and flow based on things beyond your control like missed corporate earnings, higher than expected inflation or a drought in Panama. It is up to you to choose how to live with it.

Currently, Nvidia is the rising star of the market (up of 273% over the past 12 months) but the stock market has always had high fliers like GM Motors through the 1960s and Home Depot in the 1980s. In these situations, it is easy to feel left behind and pile into a racing stock, which typically never ends well.

Here are some ways to stop the stock market regret machine:

Stick to the basics. Buy Low - Sell High. Value Stock vs Growth Stock. Buy What You Know. Spread The Risk.

Don’t Play with House Money. If you are invested in an S&P 500 index fund, you have DOUBLED your money over the last five years and you already likely own the hot stock (Nvidia currently makes up 4.6% of the S&P 500). Ignore the urge to go for a risky wager just because your other investments are doing well.

Ignore the FOMO. Fear Of Missing Out drives lots of bad decisions as you become aware of other people having a rewarding experience that you could have shared. Just remember that people usually only share their best vacation moments (not their children having a melt down at Disneyland) or their best investment bets (not the $100k they invested in the Pets.com IPO).

Use Counterfactuals. In much of life, we cannot observe what would have happened on the road not taken. Would the steak have been better than the salmon salad? Would crane operator be a more rewarding career than dentist? In the stock market, however, you can track the exact consequences of the choices you did not make. Make sure your celebrate your correct decisions just as much as the decisions that could have been. If you are new to individual stock trading or even a savvy veteran, you can simulate all your investing decisions without risking any money and see if you have the skills to beat the S&P 500 (Spoiler - Over the long term, you probably can’t).

Stay In Your Lane. You went to dental school and did not get a Masters in Finance from Penn, so stick with what your know and avoid the urge to day trade. While a successful day trader can produce average returns of around 10%, the failure rate (losing everything) for day traders is over 95%.

Take Advantage of Research. For long term investment gains, follow the advice of a Nobel Award winning economist and invest in a diversified portfolios via mutual funds or EFTs and invest regularly (referred to as dollar cost averaging) rather than dumping large sums at one time.

As we are not a Registered Investment Advisor, the information above is general in nature and should not be considered direct investment advice.

If you are looking for ways to make your practice more profitable and invest in the market, please schedule a consultation with JNG Advisors today.