The 401k - Put Your Big Boy Pants On

Ordering Off The Big Boy Menu

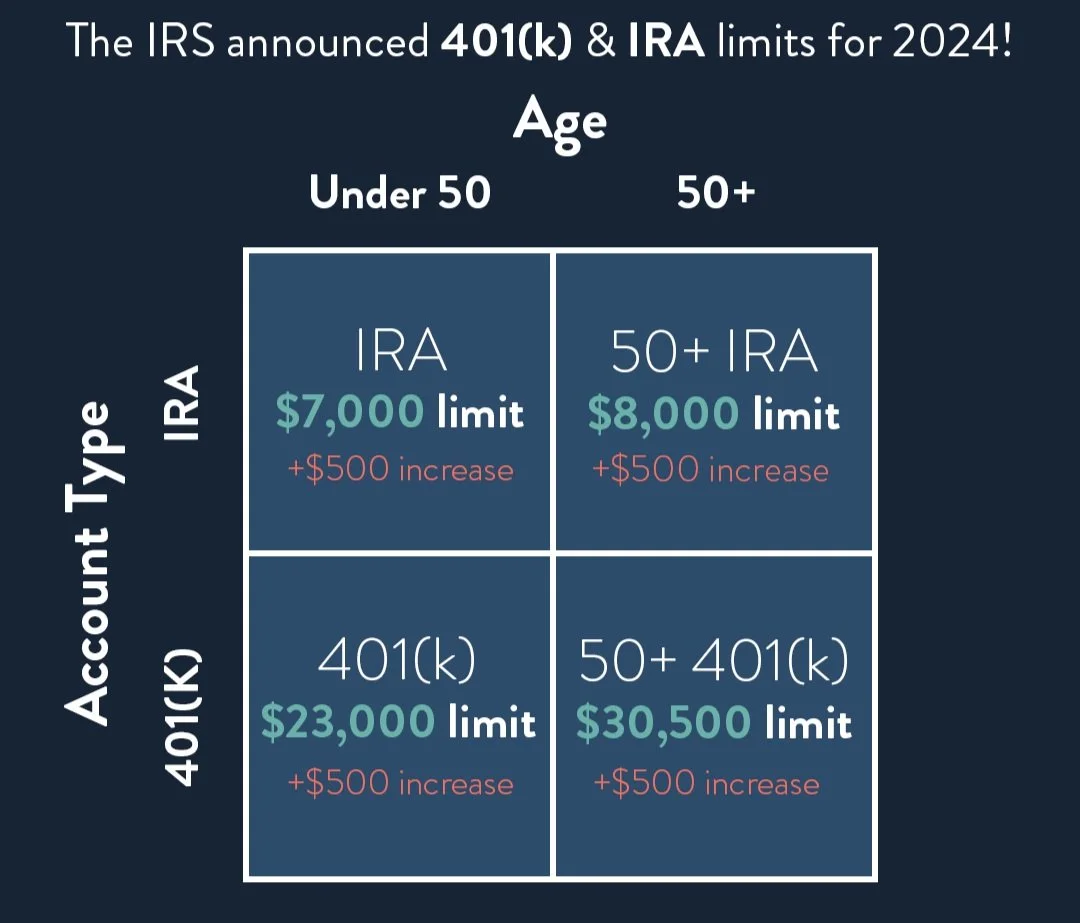

If you are a practice owner over the age of 30, it is time for you to put on your big boy pants and offer a 401k plan to your team. You should not be ordering the kid’s meal of retirement planning in the form of an individual IRA and just putting away $7,000 (limit for 2024). It is time that you order up that Double Decker 401k with large fries that will let you put away up to $69,000 (total limit for 2024).

The 401k Advantage

As you can see below, the 401k salary deferral limits are over 3x larger than an IRA if you are under 50 and nearly 4x larger after 50. This alone is reason enough to start your 401k. On top of that:

the 401k offers matching opportunities so you can add another 4% of your salary to your retirement fund as a deductible practice expense. For 2024, that match could max out at $13,800.

the 401k includes a Profit Share option to supercharge your annual 401k contribution up to a maximum of $69,000 (Employee and Employer Total Contribution).

With 401k Privilege comes 401k Responsibility

The one downside to the 401k is the additional rules and red tape created since you are technically holding and responsible for your team’s retirement funds, as well as yours. To keep this post short, here is a link to the IRS guide on Plan Sponsor (you) responsibilities. A few of the highlights:

Developing a Plan Document

Selecting the Plan’s Investment Lineup

Overseeing Employee Payroll Data

Working with your 401k Providers

Communicating with Employees

Administering Distributions and Loans

Monitoring Fees

Signing the Annual 5500 report

In years past, the cost to hire a 401k provider to handle these tasks could cost between $5,000 to $10,000 and you still had to worry about reporting requirements and annual employee notices. With digital integration and AI technology from companies like Vestwell, Guideline and Betterment, 401k plan management costs have dramatically decreased along with eliminating all but a few Plan Sponsor tasks. If you integrate your payroll with your 401k provider, your only responsibilities become:

Developing a Plan Document. Simple is Better.

Ensuring that your contributions are set to max. Your team works directly with the provider.

Submit an easy 10 question compliance survey. The provider will complete and file the 5500.

Since each practice is different and 30 was a rough estimate of when you should start a 401k, please schedule a consultation with JNG Advisors today to talk about your 401k options.